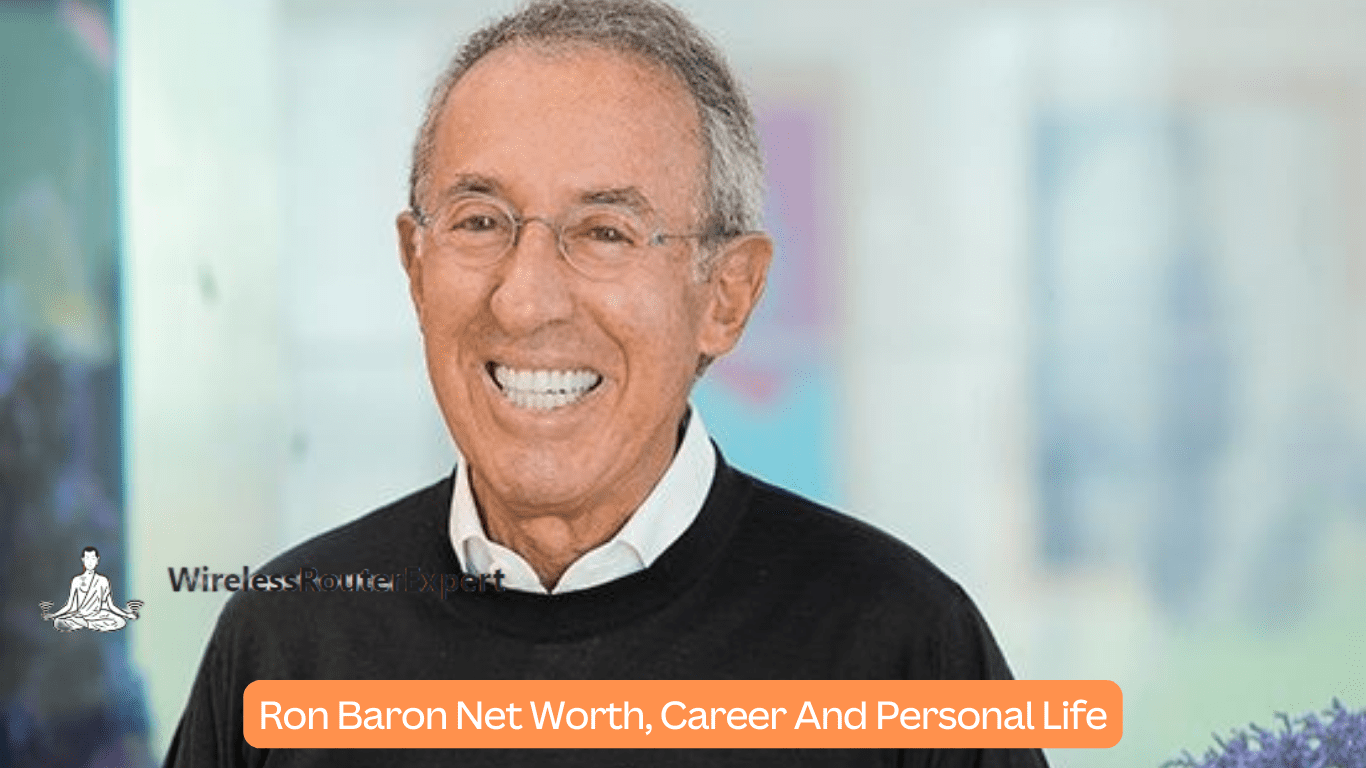

Ronald Stephen Baron (commonly known by his initials R. S. Baron), commonly referred to by his initials R. S. Baron is an influential American investor born in 1943 and known for founding investment management firm Baron Capital out of New York, amassing an estimated net worth of approximately $5 billion by November 2022. Hailing from Asbury Park New Jersey with Jewish parents, Baron graduated Bucknell University with a chemistry degree before furthering his legal studies at George Washington University Law School on a scholarship scholarship before eventually moving onto George Washington University Law School for law studies under another scholarship agreement.

What Has Led to Ron Baron’s Career in Investment?

Ron Baron began his professional life after graduation by working at the United States Patent Office, providing him with invaluable intellectual property rights knowledge before transitioning into financial services in 1982. Working for various brokerage firms and developing an affinity for investing in small companies, Baron founded Baron Capital Management soon thereafter; quickly becoming known for long-term growth strategies impacting key sectors such as healthcare affected by demographic shifts.

What Are Baron Capital Management’s Core Principles?

Baron Capital Management has long been recognized for their long-term approach to investing in growth-oriented equity markets. They focus on companies which will benefit from significant societal shifts while possessing strong management teams, competitive advantages and substantial market leadership – an approach which enabled Baron Capital Management to manage assets worth an impressive $19.5 billion by 2011.

How Has Ron Baron’s Investment Strategy Achieved Success?

One of Baron’s signature investments included his early stake in Tesla in 2014 at an average share cost of $43.07; this move demonstrated his foresight in seeing its potential before becoming an international force in electric vehicles. Furthermore, in 2012 he purchased significant portions of Manchester United Football Club stock demonstrating his ability to recognize lucrative opportunities across different fields, such as sports.

What have been Ron Baron’s Achievements and Legacies?

Ron Baron has achieved much in both his professional and personal lives, which are no less remarkable. In 2007, he made headlines when he purchased an East Hampton mansion for $103 million – at that time setting an all-time residential property transaction record at that price point. To leave behind an enduring legacy he is also engaged in charitable giving as well as building his new 28,000 sq-ft house designed by prominent New York architectural firm Hart Howerton.

How Does Ron Baron Engage His Investors?

Ron Baron has become known for his innovative way of showing appreciation to investors: hosting annual shareholder meetings featuring live rock performances as an expression of appreciation to his investors, but also reflecting his unique personality and approach to business: creative, engaging, and always forward thinking.

What Awards and Recognitions Has Ron Baron Received?

Ron Baron’s contributions to the financial industry are recognized, having received multiple honors including being honored among Worth magazine’s “Top 100 Money Managers.” Furthermore, being honored as part of Institutional Investor Hall of Fame reinforces his status in investment community circles.

What Makes Ron Baron Unique in the Investment World?

Ron Baron stands out in the investment world not only due to his successful financial maneuvers but also for his commitment to long-term gains over short-term profits. His investments in companies like Tesla and Manchester United demonstrate his ability to identify significant trends before acting upon them successfully. Furthermore, through unique events like annual shareholder meetings he adds personal touches that endear him among both investors and peers alike.

Ron Baron continues to leave an indelible mark on both his industry and community through innovative investment strategies and significant contributions, both professional and otherwise. His legacy stands as testament to both his professional successes as well as personal engagements that enrich lives of others through thoughtful investments and engagements.